Utah Tax Deductions . the following topics cover utah income tax deductions, exemptions, and dependents. The menu provides additional topics. calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal. the salary tax calculator for utah income tax calculations. Enter your salary, select your. Learn about utah's flat income tax rate, sales. Updated for 2024 with income tax and social security. calculate your federal, state and local taxes in utah based on your income, location and filing status. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024.

from www.utahfoundation.org

calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. The menu provides additional topics. the following topics cover utah income tax deductions, exemptions, and dependents. Updated for 2024 with income tax and social security. calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. Learn about utah's flat income tax rate, sales. the salary tax calculator for utah income tax calculations. Enter your salary, select your. calculate your federal, state and local taxes in utah based on your income, location and filing status. if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal.

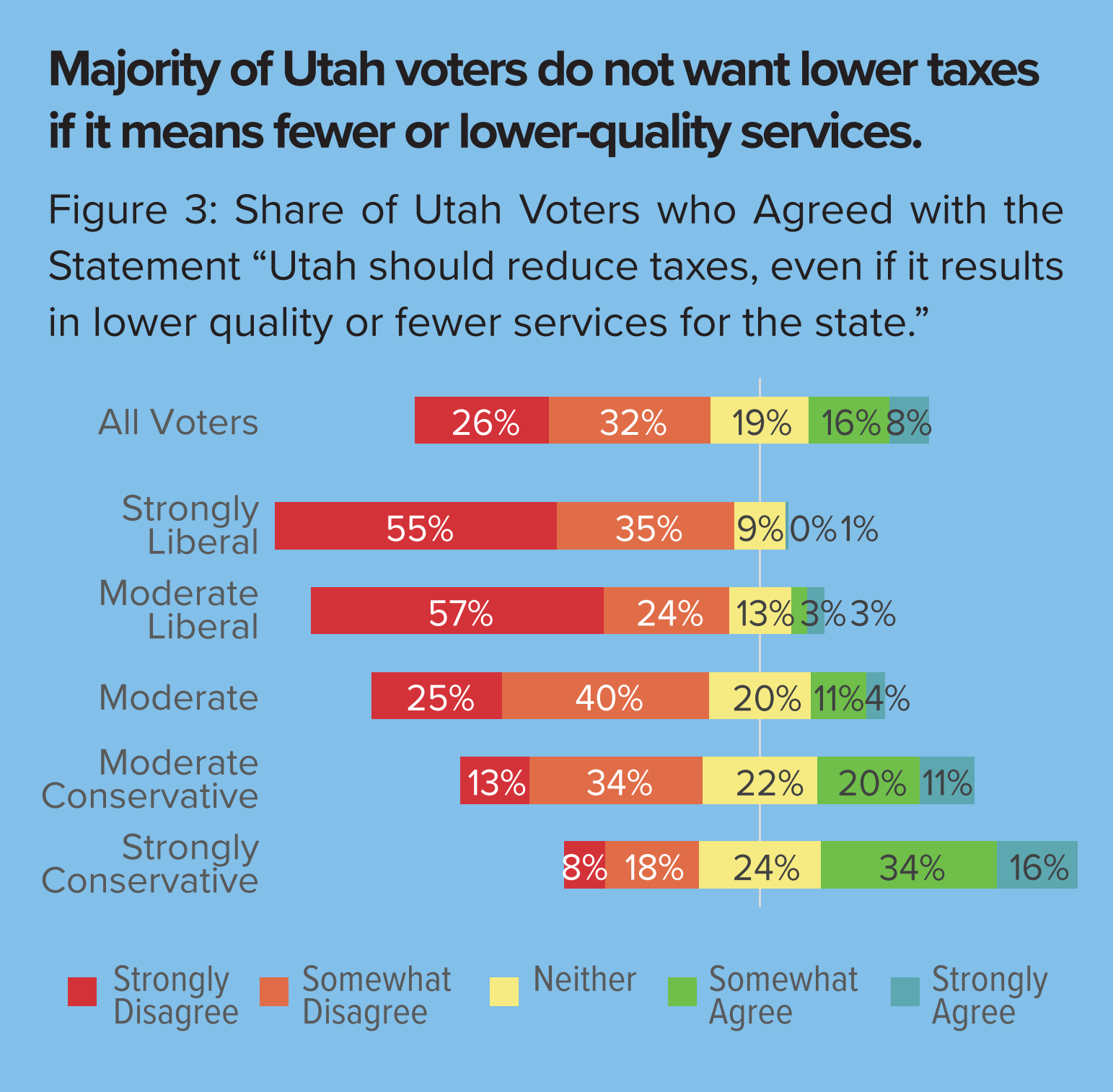

Utah Priorities 2020 Utah Priority No. 2 State Taxes and Spending

Utah Tax Deductions the salary tax calculator for utah income tax calculations. the following topics cover utah income tax deductions, exemptions, and dependents. the salary tax calculator for utah income tax calculations. calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. Learn about utah's flat income tax rate, sales. The menu provides additional topics. calculate your federal, state and local taxes in utah based on your income, location and filing status. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. Updated for 2024 with income tax and social security. if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal. Enter your salary, select your.

From napkinfinance.com

What are Tax Deductions? Napkin Finance Utah Tax Deductions Learn about utah's flat income tax rate, sales. if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal. calculate your federal, state and local taxes in utah based on your income, location and filing status. Updated for 2024 with income tax and social security. The menu provides additional. Utah Tax Deductions.

From www.zrivo.com

Utah Tax Deductions And Credits Utah Tax Deductions Enter your salary, select your. Updated for 2024 with income tax and social security. calculate your federal, state and local taxes in utah based on your income, location and filing status. The menu provides additional topics. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. calculate your take home. Utah Tax Deductions.

From taxreceipts.com

What is a Tax Deduction Utah Tax Deductions Learn about utah's flat income tax rate, sales. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. The menu provides additional topics. Updated for 2024 with income tax and social security. calculate your federal, state and local taxes in utah based on your income, location and filing status. Enter your. Utah Tax Deductions.

From klinglercpa.com

Tax Deductions for Small Businesses Utah Accountants Utah Tax Deductions Learn about utah's flat income tax rate, sales. Enter your salary, select your. the following topics cover utah income tax deductions, exemptions, and dependents. The menu provides additional topics. the salary tax calculator for utah income tax calculations. calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. calculate. Utah Tax Deductions.

From www.redrocktax.com

Maximizing Tax Deductions for Small Business Owners in Hurricane, UT Utah Tax Deductions the following topics cover utah income tax deductions, exemptions, and dependents. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. Learn about utah's flat income tax rate, sales. The menu provides additional topics. the salary tax calculator for utah income tax calculations. Enter your salary, select your. Updated for. Utah Tax Deductions.

From www.utahfoundation.org

Utah Priorities 2016, Issue 4 Taxes Utah Foundation Utah Tax Deductions if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal. calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. Updated for 2024. Utah Tax Deductions.

From www.slideshare.net

tax.utah.gov forms current tc tc941r Utah Tax Deductions Learn about utah's flat income tax rate, sales. the salary tax calculator for utah income tax calculations. Enter your salary, select your. the following topics cover utah income tax deductions, exemptions, and dependents. calculate your federal, state and local taxes in utah based on your income, location and filing status. The menu provides additional topics. calculate. Utah Tax Deductions.

From learninglibraryburger.z19.web.core.windows.net

General Sales Tax Deduction Worksheet 2022 Utah Tax Deductions calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal. The menu provides additional topics. calculate your federal, state and local taxes in utah based on your income, location and. Utah Tax Deductions.

From www.pdffiller.com

Fillable Online tax utah 2010 TC41K, Beneficiaries Share of Utah Tax Deductions The menu provides additional topics. calculate your federal, state and local taxes in utah based on your income, location and filing status. if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal. Enter your salary, select your. Updated for 2024 with income tax and social security. the. Utah Tax Deductions.

From www.utahfoundation.org

Utah Priorities 2020 Utah Priority No. 2 State Taxes and Spending Utah Tax Deductions Enter your salary, select your. The menu provides additional topics. the salary tax calculator for utah income tax calculations. calculate your federal, state and local taxes in utah based on your income, location and filing status. if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal. . Utah Tax Deductions.

From slideplayer.com

Tax Forms & Deductions. ppt download Utah Tax Deductions calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. Learn about utah's flat income tax rate, sales. Updated for 2024 with income tax and social security. The menu provides additional topics. calculate your federal, state and local taxes in utah based on your income, location and filing status. if. Utah Tax Deductions.

From old.sermitsiaq.ag

Printable Tax Deduction Cheat Sheet Utah Tax Deductions if you deducted any state and/or local income tax you paid as an itemized deduction on your previous year's federal. calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. the salary. Utah Tax Deductions.

From www.liveenhanced.com

Utah Charity Car Donation and Tax Deductions Live Enhanced Utah Tax Deductions calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. calculate your federal, state and local taxes in utah based on your income, location and filing status. Updated for 2024 with income tax and social security. the following topics cover utah income tax deductions, exemptions, and dependents. Learn about utah's. Utah Tax Deductions.

From www.zrivo.com

Utah Tax Deductions And Credits Utah Tax Deductions The menu provides additional topics. calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. the salary tax calculator for utah income tax calculations. Updated for 2024 with income tax and social security. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024.. Utah Tax Deductions.

From incometax.utah.gov

Use Tax Utah Taxes Utah Tax Deductions calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. the salary tax calculator for utah income tax calculations. The menu provides additional topics. Learn about utah's flat income tax rate, sales. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. . Utah Tax Deductions.

From martinasambhavi.blogspot.com

17+ Tax Calculator Utah MartinaSambhavi Utah Tax Deductions calculate your federal, state and local taxes in utah based on your income, location and filing status. Learn about utah's flat income tax rate, sales. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. the salary tax calculator for utah income tax calculations. Updated for 2024 with income tax. Utah Tax Deductions.

From jeremyeveland.com

Utah Estate Tax Deductions Jeremy Eveland Utah Tax Deductions Enter your salary, select your. The menu provides additional topics. calculate your federal, state and local taxes in utah based on your income, location and filing status. Learn about utah's flat income tax rate, sales. calculate your take home pay per paycheck for both salary and hourly jobs in utah after taxes. the following topics cover utah. Utah Tax Deductions.

From www.utahfoundation.org

Utah Priorities 2020 Utah Priority No. 2 State Taxes and Spending Utah Tax Deductions the following topics cover utah income tax deductions, exemptions, and dependents. Enter your salary, select your. calculate your annual, monthly, weekly or hourly income tax and take home pay in utah for 2024. Learn about utah's flat income tax rate, sales. the salary tax calculator for utah income tax calculations. calculate your federal, state and local. Utah Tax Deductions.